95%

Conversion Rate

30%

Fewer Pre-Settlement Requirements

85%

docs returned within six days

7%

Higher Conversion

Reduce Settlement Turnaround Times.

First launched in 2016, DigiDocs is MSA’s e-sign solution

that delivers speed to sign for:

New Loans

Variations

Guarantees & SMSF

All states and territories

Reimagine the way you Sign

Speed to Issue

AI-Powered Instruction Verification & Document Quality Assurance.

Speed to Sign

Up to 41% of documents signed and verified within 3 hours.

Speed to Settle

Reduces settlement turnaround times by 1.24 days.

90 Second Docs.

Loan Documents issued within 90 seconds of Loan Approval.

Speed to issue results in speed to sign.

Correct Once. Perfect Always.

If a borrower enters incorrect information, MSA reissues only the affected documents – reducing friction, and improving the customer experience.

Sign Simple. Eliminate Confusion.

Pre-populated fields, only prompting borrowers to complete information only when necessary. Automatic validation reduces errors.

Speed to sign results in speed to settle.

Lenders who partner with MSA National experience exponential growth

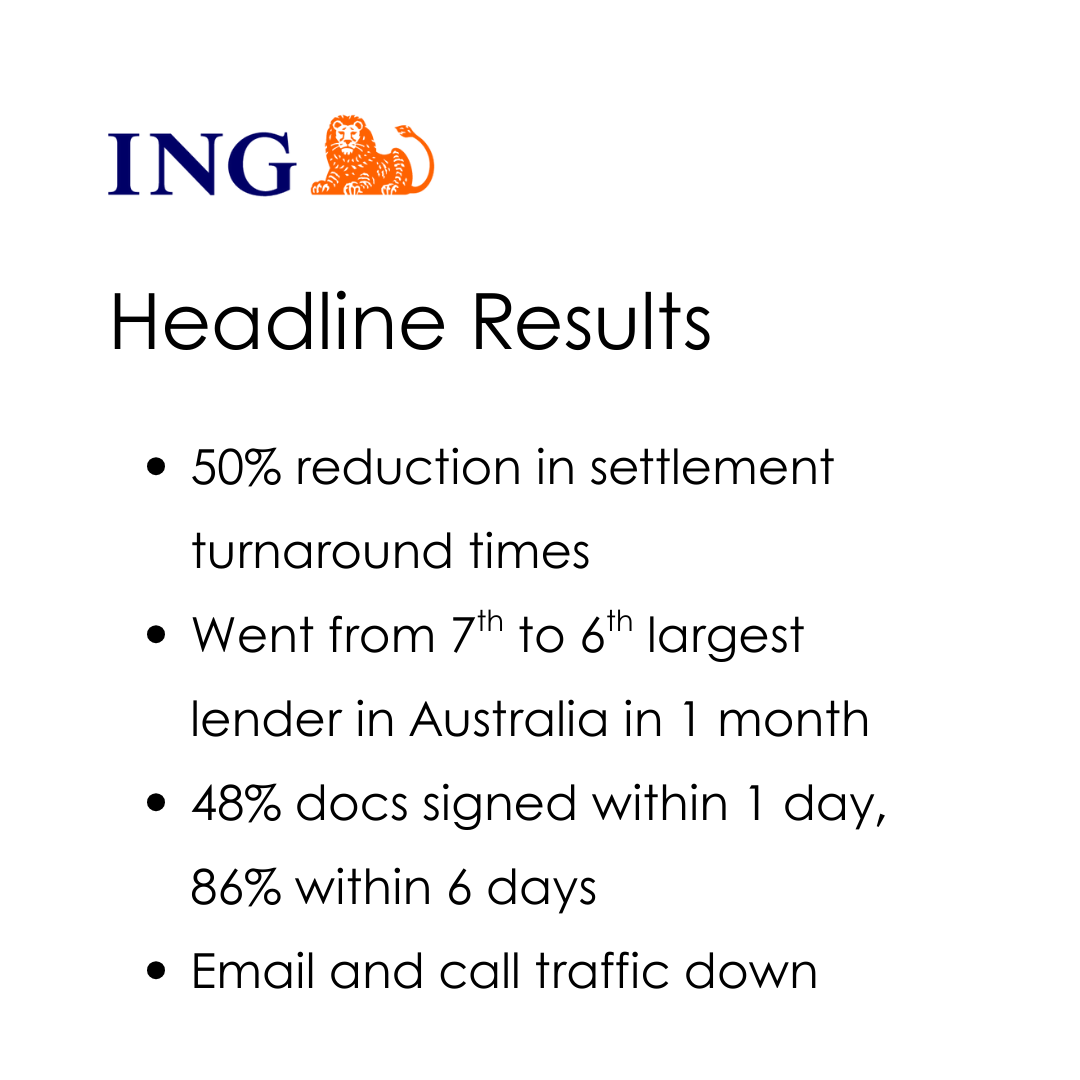

“Since partnering exclusively with MSA National, we have significantly improved our service delivery & turnaround times resulting in consistently positive feedback from mortgage brokers and customers. This enhanced experience is driving increased volumes and strengthening broker relationships.”

National Sales Manager, ING

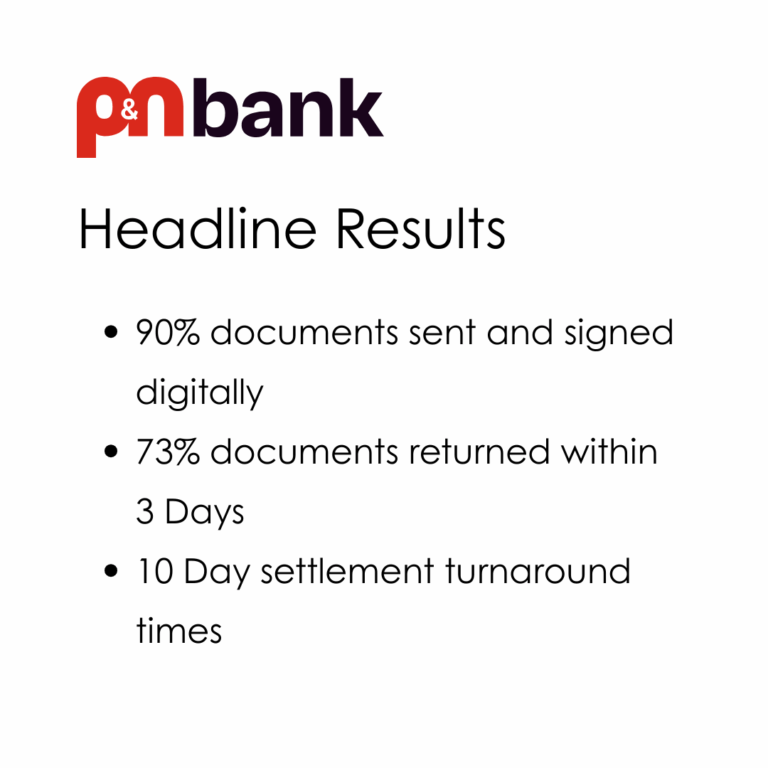

“Through MSA, our overall home loan process has been streamlined to reduce touch points, allowing us to service our brokers in a timely manner.

the move to MSA comes off the back of our five-year transformation program which has provided brokers with a faster and more consistent experience that retains the all-important personal connection.

Chief Retail Banking Officer, P&N

A Faster Settlement With MSA National

Lender Branding

Document packs are all fully customisable to reflect the lender’s specific tone of voice and unique pain points.

Tailored Checklists

Borrowers receive tailored checklists that explain exactly what is needed—reducing confusion, errors, & support calls.

Direct Upload Functionality

Direct ability for borrowers to upload documents when signing meaning fewer outstanding requirements.

Compelling Reasons To Partner With MSA National

Speed & Simplicity

Reduction of settlement turnaround times by 13 days through leading settlement tech, built in-house.

File Ownership

Unique model providing a single point of contact for customers and brokers, ensuring continuity of service.

Security

ISO 27001:2022 certification demonstrates our commitment to security and our ability to safeguard the data that we store, process & transmit.

In-House Expertise

MSA has in-house expertise in both technology and legal precedent, with no outsourcing involved.

See the blueprint for success with examples of 10 questions to ask when evaluating e-Sign Solutions.